ostashkovadm.ru

Prices

Increase Credit Score Quick

Pay down your highest interest credit cards first, leave yourself some money, even a small amount for any possible shortfalls that you might. Tips and tools to improve your credit score · Improving your credit score takes time · Remember to read your credit report · Raise your score by paying on time. What actions you can take to boost your credit scores? · Pay your bills more frequently. · Pay down your debt but keep old credit accounts open. · Request an. Honestly, there are few fast fixes with credit. However, one thing that can work quickly, is paying down credit card balances. If you have high. How to Improve Your Credit Score · 1. Make On-Time Payments · 2. Pay Down Revolving Account Balances · 3. Don't Close Your Oldest Account · 4. Diversify the. Nothing will raise your credit score faster or more effectively than paying bills on time and using your credit cards judiciously. How to Improve Your Credit Score Fast · 1. Review Your Credit Reports · 2. Get a Handle on Bill Payments · 3. Aim for 30% Credit Utilization or Less · 4. Limit. 1. PAY YOUR BILLS ON TIME Paying your bills on time is one of the easiest things you can do to consistently improve your credit score. 4 tips to boost your credit score fast · 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4. Pay down your highest interest credit cards first, leave yourself some money, even a small amount for any possible shortfalls that you might. Tips and tools to improve your credit score · Improving your credit score takes time · Remember to read your credit report · Raise your score by paying on time. What actions you can take to boost your credit scores? · Pay your bills more frequently. · Pay down your debt but keep old credit accounts open. · Request an. Honestly, there are few fast fixes with credit. However, one thing that can work quickly, is paying down credit card balances. If you have high. How to Improve Your Credit Score · 1. Make On-Time Payments · 2. Pay Down Revolving Account Balances · 3. Don't Close Your Oldest Account · 4. Diversify the. Nothing will raise your credit score faster or more effectively than paying bills on time and using your credit cards judiciously. How to Improve Your Credit Score Fast · 1. Review Your Credit Reports · 2. Get a Handle on Bill Payments · 3. Aim for 30% Credit Utilization or Less · 4. Limit. 1. PAY YOUR BILLS ON TIME Paying your bills on time is one of the easiest things you can do to consistently improve your credit score. 4 tips to boost your credit score fast · 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4.

Although there isn't an overnight fix, there are quick and simple ways to give your credit score a boost — and using Loqbox is one of them. Here are four such options designed for consumers without credit—or those with a low credit score—which can help boost your credit rating at no cost to you. One of the easiest ways to improve your credit score is by paying your bills on time every month. This will start to eliminate your credit card debt. Your. How to build credit fast · 1. Pay credit card balances strategically · 2. Ask for higher credit limits · 3. Become an authorized user · 4. Pay bills on time · 5. Steps to increase your credit score quickly; Lower your credit utilization rate; Ask for late payment forgiveness; Dispute incorrect credit report info; Add. What actions you can take to boost your credit scores? · Pay your bills more frequently. · Pay down your debt but keep old credit accounts open. · Request an. Find a co-signer. Another helpful way to build credit is by having a co-signer for certain loans, with the co-signer being responsible for the full loan. Experian Boost is an easy way for you to take control of your credit and build long-term credit health—just by paying your bills. When you connect your bank or. But it generally takes about three to six months to get your first credit score. The timing depends on factors like what your credit scores are now and how you'. You can optimize this by adjusting both variables; you can spend less, and you can open new credit accounts or ask for increases on your existing credit limits. Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score. How to improve your credit scores · 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Pay your bills on time · 4. Make payments on. Here are six ways to elevate your credit score, from those that can produce fast results to ones that require a slow and steady approach. 1. Lower Your Credit Utilization Ratio. Each line of credit you have has a maximum amount. The percentage of that that you've charged is your credit. How To Increase Your Credit Score · 1. Read Your Credit Report · 2. Pay Your Bills on Time · 3. Set Up Payment Plans With Creditors · 4. Limit Applying for New. Learn the basics of how to build credit, how to use credit cards and practice positive credit behavior. You can optimize this by adjusting both variables; you can spend less, and you can open new credit accounts or ask for increases on your existing credit limits. If your creditworthiness has taken a ding, these fixes should spruce it up · 1. Check your credit report at least once a year · 2. Set up automatic bill payment. That means paying down outstanding debt is one of the most effective ways to raise your credit score quickly. We know that's easier said than done. You might. But it generally takes about three to six months to get your first credit score. The timing depends on factors like what your credit scores are now and how you'.

How To Get Rid Of Mortgage Insurance Early

Can You Get Rid Of Mortgage Insurance Premiums (MIP)? · Loan closed on or after June 3, Down payment of less than 10%: MIP is never removed. Down payment. FHA insures mortgages so that lenders will be encouraged to make more mortgages available for people. The FHA mortgage insurance agreement is between FHA and. 4 options to get rid of PMI · Wait for PMI to terminate automatically. · Request PMI cancellation. · Refinance to get rid of PMI. · Refinance into a piggyback loan. 3 Ways to Cancel Private Mortgage Insurance (PMI) on a Conventional Loan · 1) Automatic Termination Guidelines · 2) Borrower-Initiated Cancellation (Based on. Refinancing your mortgage may lower the interest rate or eliminate mortgage insurance premiums. By reducing interest charges and getting rid of mortgage. Request PMI cancellation. Once your loan balance reaches 80% of the original purchase payment, you can request to have your PMI canceled rather than waiting. If. Refinance into a piggyback loan to get rid of PMI. If you don't yet have at least 20% in home equity, you can split your refinance into a first and second. PMI is insurance for your lender not for you, but you pay for the coverage in addition to your mortgage payment each month. These payments could cost you. You can contact your lender and request an early termination of PMI as soon as you've paid your mortgage down enough to have an 80% loan-to-value ratio (LTV). Can You Get Rid Of Mortgage Insurance Premiums (MIP)? · Loan closed on or after June 3, Down payment of less than 10%: MIP is never removed. Down payment. FHA insures mortgages so that lenders will be encouraged to make more mortgages available for people. The FHA mortgage insurance agreement is between FHA and. 4 options to get rid of PMI · Wait for PMI to terminate automatically. · Request PMI cancellation. · Refinance to get rid of PMI. · Refinance into a piggyback loan. 3 Ways to Cancel Private Mortgage Insurance (PMI) on a Conventional Loan · 1) Automatic Termination Guidelines · 2) Borrower-Initiated Cancellation (Based on. Refinancing your mortgage may lower the interest rate or eliminate mortgage insurance premiums. By reducing interest charges and getting rid of mortgage. Request PMI cancellation. Once your loan balance reaches 80% of the original purchase payment, you can request to have your PMI canceled rather than waiting. If. Refinance into a piggyback loan to get rid of PMI. If you don't yet have at least 20% in home equity, you can split your refinance into a first and second. PMI is insurance for your lender not for you, but you pay for the coverage in addition to your mortgage payment each month. These payments could cost you. You can contact your lender and request an early termination of PMI as soon as you've paid your mortgage down enough to have an 80% loan-to-value ratio (LTV).

If you are current on your mortgage payments, PMI will automatically terminate when your principal balance is 78 percent of the original home value, which means. How to remove PMI. Generally, once you reach 20% equity or when you pay your loan balance down to 80% of the purchase price of your home, you. In order to cancel, the borrower must also have a good payment history on the loan and satisfy the mortgage holder's other requirements for evidence that the. Forward any unearned MIP refund to the borrower as soon as it is received from the mortgage insurer, but no later than 45 days after the MI termination date. To request cancellation of PMI, you should contact your loan servicer when the loan balance falls below 80 percent of your home's original value (the contract. Ask your lender or mortgage servicer for information about these requirements. If you signed your mortgage before July 29, you can request to have the PMI. Once you've built equity of 20% in your home, you can cancel your PMI and remove that expense from your monthly payment. If you're current on your mortgage. 31, , and June 3, , and the LTV is 78% or less, you can contact the lender and request to have the mortgage insurance removed. If you took out the. Early removal of PMI may be subject to certain conditions that you must meet; such as payment history, time frame of your loan, value, etc. In order to. The very first step to remove Private Mortgage Insurance is to contact the mortgage servicer and request the details regarding PMI cancellation. The good news is that you can request that your lender remove PMI once the principal balance of your loan reaches 80% of the original value of the property. To. Save money by asking your mortgage company to cancel your private mortgage insurance (PMI). · When the Law Requires a Lender to Cancel PMI · When the Lender Must. Removing PMI · Your property must reach at least 20% equity—or 80% LTV—to be eligible for an early cancellation. · Also, other conditions may apply to early. The borrower must provide the lender a written request for mortgage insurance cancellation. Upon receiving the request, the lender must cancel the mortgage. Ways to remove PMI. PMI can be removed during a refinance if you have reached 20% equity. You can speed up the process of reaching % by. A loan recast is another great approach to removing PMI. If a recast drops your Loan-To-Value ratio (LTV) to 80% or below, your loan will become eligible for. Yes, it is absolutely worth it to get rid of PMI as soon as possible. PMI stands for Private Mortgage Insurance. It allows lenders to make a. Early removal of PMI may be subject to certain conditions that you must meet; such as payment history, time frame of your loan, value, etc. In order to. The traditional way to get out of mortgage insurance on any government-insured home loan is to refinance into a conventional mortgage when you hit 20% equity. FHA insures mortgages so that lenders will be encouraged to make more mortgages available for people. The FHA mortgage insurance agreement is between FHA and.

Zero Percent Credit Cards For 18 Months

My bank is offering a 0% interest for 18 months. I have 4k on a creditcard. The interest each month alone eats half my progress. Purchases and balance transfers are interest free with 0% intro APR for 18 months from account opening, after that a variable APR of Min. of (+). Introductory 0% † APR for your first 18 billing cycles for purchases, and for any balance transfers made within 60 days of opening your account. After the intro. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. With a 0% intro APR on balance transfers for the first 18 billing cycles, thereafter a variable APR of % - %, and no annual fee, the value of our. Longest 0% APR Credit Cards for Balance Transfers of August ; Best Intro APR Balance Transfer Card With Cellphone Protection From Wells Fargo (21 months). 13 Best 0% interest credit cards of September · + Show Summary · Wells Fargo Reflect® Card · Discover it® Cash Back · Capital One VentureOne Rewards. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. Turn eligible credit card purchases into equal monthly payments over 6, 12 or 18 months - for a fee and 0% Annual Interest Rate. Conditions apply. This. My bank is offering a 0% interest for 18 months. I have 4k on a creditcard. The interest each month alone eats half my progress. Purchases and balance transfers are interest free with 0% intro APR for 18 months from account opening, after that a variable APR of Min. of (+). Introductory 0% † APR for your first 18 billing cycles for purchases, and for any balance transfers made within 60 days of opening your account. After the intro. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. With a 0% intro APR on balance transfers for the first 18 billing cycles, thereafter a variable APR of % - %, and no annual fee, the value of our. Longest 0% APR Credit Cards for Balance Transfers of August ; Best Intro APR Balance Transfer Card With Cellphone Protection From Wells Fargo (21 months). 13 Best 0% interest credit cards of September · + Show Summary · Wells Fargo Reflect® Card · Discover it® Cash Back · Capital One VentureOne Rewards. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. Turn eligible credit card purchases into equal monthly payments over 6, 12 or 18 months - for a fee and 0% Annual Interest Rate. Conditions apply. This.

A 0% APR credit card offers no interest for a period of time, typically six to 21 months. During the introductory no interest period, you won't incur interest. 0% Intro APR on balance transfers for 15 months from date of first transfer and on purchases from date of account opening. After that, the variable APR will be. Our partners' introductory 0% APR credit cards promotional periods last for 6–18 months. After the intro APR period is over, the interest rate on the. Cash Equivalent Fee: 5% of each transaction amount, $10 minimum. KeyBank Latitude, Key Cashback and Key2More Rewards®: The introductory rate does not apply to. 13 Best 0% interest credit cards of September · + Show Summary · Wells Fargo Reflect® Card · Discover it® Cash Back · Capital One VentureOne Rewards. The Wells Fargo Reflect® Card has a unique offer with a 0% intro APR for 18 months, which you may extend by up to 3 months by making on-time minimum payments. 0% Intro APR Card Offers (5) ; Blue Cash Everyday® Card. No Annual Fee · 3% cash back at U.S. supermarkets on up to $6K in purchases (then 1%) ; Blue Cash. For a limited time, get our best rate ever: 0% intro APR* on purchases and balance transfers† for 21 billing cycles. After that, the APR is variable, currently. Cards that offer zero interest — also called zero annual percentage rate (APR) cards — are ideal for large purchases or emergencies because they don't. Slate Edge credit card · Save on interest with a low intro APR for 18 months ; Chase Freedom Unlimited credit card · Earn a $ bonus · Unlimited % cash back is. Explore low intro rate credit cards ; 0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee applies. See pricing and terms. Intro purchase APR is 0% for 6 months from date of account opening then the standard purchase APR applies. Intro Balance Transfer APR is % for 6 months. interest - I have never paid credit card interest on any of my cards). My total credit limit for all my cards is about 75k+. I have 4 years. Our credit card experts hand selected the cards below because of their long 0% intro APR interest offers. These offers range from 12 months all the way up to Visa® Signature · 0% APR for the first 18 months (variable % or % APR after the introductory period) · Unlimited % cash back on every purchase · No. Our partners' introductory 0% APR credit cards promotional periods last for 6–18 months. After the intro APR period is over, the interest rate on the. Balance transfer 0% introductory APR for first 18 billing cycles after account opening. After that, %, %, %, % or % variable APR based. Save interest on big purchases with a 0% intro APR. Get zero interest for up to 15 months or more. Compare 0% intro APR cards of and apply. The Wells Fargo Reflect® Card has a unique offer with a 0% intro APR for 18 months, which you may extend by up to 3 months by making on-time minimum payments.

Abcd Pattern Trading

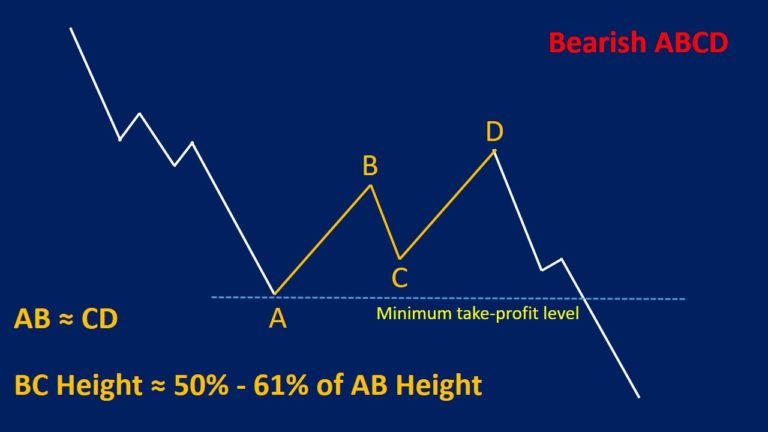

How does the ABCD pattern work? The pattern involves identifying an initial price move from A to B (AB leg) and then a corrective move from B to C (BC leg). In my tests, I used 1% because this pattern occurs so frequently, a larger percentage is not necessary. See Trading Tips for an explanation of this. I used a. For both the bullish and bearish versions of the ABCD chart pattern, the lines AB and CD are known as the legs while BC is called the correction or retracement. ABCD is a harmonic pattern which can be used for opening great trades. Learn more about it! Trading ABCD Patterns is designed to help satisfy Critical Element number one of the Plan for a Trade, the Potential Trade Area (PTA). The ABCD pattern is a common technical analysis pattern used by traders to identify potential trading opportunities in the financial markets. This pattern is. The ABCD pattern is a harmonic formation on trading charts with four reversal points (A, B, C, and D) resembling a lightning bolt. It's a versatile tool used in. The ABCD Pattern drawing tool allows analysts to highlight various four point chart patterns. Users can manually draw and maneuver the four separate points . The ABCD pattern is a highly effective tool utilized in trading to identify potential opportunities across diverse markets, including forex, stocks. How does the ABCD pattern work? The pattern involves identifying an initial price move from A to B (AB leg) and then a corrective move from B to C (BC leg). In my tests, I used 1% because this pattern occurs so frequently, a larger percentage is not necessary. See Trading Tips for an explanation of this. I used a. For both the bullish and bearish versions of the ABCD chart pattern, the lines AB and CD are known as the legs while BC is called the correction or retracement. ABCD is a harmonic pattern which can be used for opening great trades. Learn more about it! Trading ABCD Patterns is designed to help satisfy Critical Element number one of the Plan for a Trade, the Potential Trade Area (PTA). The ABCD pattern is a common technical analysis pattern used by traders to identify potential trading opportunities in the financial markets. This pattern is. The ABCD pattern is a harmonic formation on trading charts with four reversal points (A, B, C, and D) resembling a lightning bolt. It's a versatile tool used in. The ABCD Pattern drawing tool allows analysts to highlight various four point chart patterns. Users can manually draw and maneuver the four separate points . The ABCD pattern is a highly effective tool utilized in trading to identify potential opportunities across diverse markets, including forex, stocks.

The ABCD pattern is a chart pattern that can indicate that the market is about to move in a particular direction. It can be used to trade both reversals and. You are about to be introduced to a truly amazing geometry trading pattern which professional traders and brokers do not want you to know about. Put simply, it. The ABCD chart pattern allows traders to determine when a trend may weaken and reverse. Trading signals can be derived from the pattern. Back to Using the Harmonic AB=CD Pattern to Pinpoint Price Swings · ABCD Pattern Trading Strategy · «previous in gallery next in gallery». mobile desktop. The ABCD trading pattern is one of the easiest harmonic patterns to recognise on a price chart, indicated by a four point movement. ABCD is the simplest harmonic pattern. Trading with this pattern requires the Fibonacci retracement tool. ABCD Pattern. No matter if the ABCD pattern is. Traders may interpret longer patterns as a sign to move to a larger timeframe to check for trend/Fibonacci convergence. The ABCD pattern is a leading indicator. r/Trading - ABCD PATTERN from TANDEM TRADER D A BREAKOUT. Get inspired and try out new things. Abcd Pattern Trading, Abcd Chart, Harmonic Pattern, Japanese Candlesticks Patterns, Candlestick Chart · How to trade. ABCD – Bullish. ABCD is a popular harmonic pattern for trading reversals. Renko ABCD is an attempt to make that pattern objective considering the advantage of. ABCD The ABCD is a basic harmonic pattern. All other patterns derive from it. The pattern consists of 3 price swings. The lines AB and CD are called “legs”. In this pattern, the A to B leg is the first price move. After a brief retracement from point B to point C, the pattern will complete the C to D leg, which is. The bearish ABCD pattern is a prominent technical analysis tool that highlights an ascending formation on a trading chart, insinuating the. John called it the ABC pattern, which he defines in simple terms: "It's a stop run of the first pullback after an aggressive move to the upside that signifies. ABCD is a Fibonacci pattern that is a combination of 3 Point Extension and 3 Point Retracement. It is defined by four points A, B, C, and D. ABCD pattern captures the typical rhythmic pattern of the market, which traders use to identify trading opportunities. Since ABCD patterns work on different. The ABCD pattern is a simple day trading strategy, perfect for beginners. It's straightforward and easy to understand – just like connecting. The ABCD pattern is a blend of time, price, and shape. When all three merge at one point, the pattern forms an electric move that traders can. ABCD Pattern Meaning. Unfortunately, the Starbucks phenomenon can creep over when new traders try to pick a day trading strategy. With so many choices. The ABCD pattern is a well-known technical analysis tool used in Forex trading. It is a pattern that traders use to identify potential buy and sell signals.

Cost To Install Tennis Court

A high-quality outdoor tennis court will cost between $ and $ to install. A professional installation will necessitate the use of. A post-tensioned court is about double the price of asphalt. what height of fencing should I have around my court. The starting cost to install a grass tennis court typically starts at $45, but that number can quickly increase to six figures. Artificial Grass or AstroTurf. Building a home tennis court varies but typically ranges from $20, to $80, Factors include court size, surface type, and site preparation. Additional. How much money? According to HomeGuide, the average cost to construct a tennis court (regulation doubles size) runs around $65,; costing around $5 to $14 per. Each court will also vary depending on what options are selected such as fence type, lighting, retaining walls, water runoff management, permits, and local. The cost of building an outdoor clay tennis court is $$45 /m² and around $$23/m² for indoor ones. That's a pretty broad range. For tennis court resurfacing or restoration, costs can range from $10, to $30,+ per court. This depends on the current condition of the court, the number. From excavation to installation, installing a new grass tennis court will cost anywhere from $50, to $, Daily maintenance—watering, mowing, and. A high-quality outdoor tennis court will cost between $ and $ to install. A professional installation will necessitate the use of. A post-tensioned court is about double the price of asphalt. what height of fencing should I have around my court. The starting cost to install a grass tennis court typically starts at $45, but that number can quickly increase to six figures. Artificial Grass or AstroTurf. Building a home tennis court varies but typically ranges from $20, to $80, Factors include court size, surface type, and site preparation. Additional. How much money? According to HomeGuide, the average cost to construct a tennis court (regulation doubles size) runs around $65,; costing around $5 to $14 per. Each court will also vary depending on what options are selected such as fence type, lighting, retaining walls, water runoff management, permits, and local. The cost of building an outdoor clay tennis court is $$45 /m² and around $$23/m² for indoor ones. That's a pretty broad range. For tennis court resurfacing or restoration, costs can range from $10, to $30,+ per court. This depends on the current condition of the court, the number. From excavation to installation, installing a new grass tennis court will cost anywhere from $50, to $, Daily maintenance—watering, mowing, and.

While constructing a standard tennis court typically costs between $ and $, it's important to factor in the cost of permits, ongoing maintenance. How much does it cost to resurface a court? The average cost to resurface a Tennis Court is between $18, and $22, (Note: which can also include converting. It is especially preferred in estates and detached living areas. With 28 years of experience in the sports grounds sector, we are able to install tennis courts. A Sporturf tennis court including fence typically costs £63, to £73, plus VAT. From a single private tennis court installation through to a new pitch. The cost to build a tennis court typically ranges between $25, – $, for a regulation-sized court. The price of a tennis court depends on many. You can save money by repairing or resurfacing an existing court. 3. Weather and climate. If you are installing a tennis court in a colder climate with freeze-. The national average cost for resurfacing a tennis court is between $8, and $12,, with most people paying around $10, to repair and resurface a. The average cost of a tennis court installation by type is $45, to $90,, depending on whether it is a singles court or a doubles court, among other. Cost of a multi-sport game court can range from $6, - $19,* As with most construction projects, the cost to build multi-sport game court can vary. Pad Job Materials and Supplies, Square Feet, $ ; Pad Equipment Allowance, $ ; Totals - Cost to Install Concrete Pads - Square Feet, $2, The current average for the cost of building a basic tennis court is generally going to be between $25, and $50, For those who want to have a high-end. Overall, installing a tennis court yourself can range anywhere from $3,$50, Thus, it's important to research and prepare for any hidden costs that could. A basic tennis court resurfacing cost generally ranges from $4, to $10, Major resurfacing costs can range anywhere from $15, to $80, if the needs. Are you looking to get an indoor or outdoor tennis court installed at your facility? Visit our website to calculate the cost of installation for a variety. Tennis Court Construction Costs. Construction costs range from $30, to $, These prices include surface preparation, laying a base, installing a. A basic backyard basketball court might cost $10, to $30,, while a tennis court could be $20, to $80,+. Excavation, land prep. courts are available to rent for a fee. During the outdoor season (May – September), 11 courts are available for Parks tennis permit holders. For booking courts. Our ability to travel - We can mobilize our crews to install your indoor tennis court structure anywhere in the continental U.S.. Fabric Building and Indoor. The type of court you decide to build will play a large role in the initial installation cost and continuing maintenance. In general, you will need to choose. The Construction Costs of Tennis Courts. Building a tennis court is a big investment and can cost anywhere from $25, to $, depending on There are.

Best Sites To Use For Investing

Investopedia is the world's leading source of financial content on the web, ranging from market news to retirement strategies, investing education to. Find commercial real estate services and property investment strategies. We work with owners, tenants and investors in the local, national and global. Most Visited Investing Websites ; 5, ostashkovadm.ru, Finance > Investing ; 6, ostashkovadm.ru, Finance > Investing ; 7, ostashkovadm.ru, Finance > Investing ; 8, rakuten-sec. The key benefit of eToro is its unique social trading experience, allowing you to copy successful traders' trades. It also provides various financial. Official websites ostashkovadm.ru ostashkovadm.ru website belongs to an official government Financial tools and calculators; Investing FAQs; Tips to avoid investment. Morningstar is an investment research company offering mutual fund, ETF, and stock analysis, ratings, and data, and portfolio tools. Here are the best online brokerage accounts and trading platforms with low costs and fees plus the best trading experience, mobile apps, and more. Best for investors who want access to initial public offerings (IPOs). Based on past offerings, the best choice is Fidelity, which provided its customers access. Best Credit Cards · Best Stock Brokers and Trading Platforms · Best CD Rates · Best Mortgage Lenders Use · Privacy Policy · Disclosure Policy · Accessibility. Investopedia is the world's leading source of financial content on the web, ranging from market news to retirement strategies, investing education to. Find commercial real estate services and property investment strategies. We work with owners, tenants and investors in the local, national and global. Most Visited Investing Websites ; 5, ostashkovadm.ru, Finance > Investing ; 6, ostashkovadm.ru, Finance > Investing ; 7, ostashkovadm.ru, Finance > Investing ; 8, rakuten-sec. The key benefit of eToro is its unique social trading experience, allowing you to copy successful traders' trades. It also provides various financial. Official websites ostashkovadm.ru ostashkovadm.ru website belongs to an official government Financial tools and calculators; Investing FAQs; Tips to avoid investment. Morningstar is an investment research company offering mutual fund, ETF, and stock analysis, ratings, and data, and portfolio tools. Here are the best online brokerage accounts and trading platforms with low costs and fees plus the best trading experience, mobile apps, and more. Best for investors who want access to initial public offerings (IPOs). Based on past offerings, the best choice is Fidelity, which provided its customers access. Best Credit Cards · Best Stock Brokers and Trading Platforms · Best CD Rates · Best Mortgage Lenders Use · Privacy Policy · Disclosure Policy · Accessibility.

Best Sites to Learn Beginner Investing Online · *Note: We are always in the process of reviewing different platforms, so don't hesitate to check back. · eToro (US. Stocks, ETFs and high interest with zero commissions and powerful automation. Start building wealth today! Committed to the financial health of our customers and communities. Explore bank accounts, loans, mortgages, investing, credit cards & banking services». Online investing opportunities in the best new startup businesses, and raise seed and angel investment, with top European equity crowdfunding site Republic. The top online brokerage accounts for trading stocks in August · Charles Schwab · Fidelity Investments · Robinhood · E-Trade · Interactive Brokers · Merrill Edge. What would you like the power to do? For you and your family, your business and your community. At Bank of America, our purpose is to help make financial. Pursue your goals with stocks, options, ETFs, mutual funds, and more. Easy-to-use tools. Powerful, intuitive platforms. Trade online, through Power E*TRADE, or. Standard online $0 commission does not apply to over-the-counter (OTC) equities, transaction-fee mutual funds, futures, fixed-income investments, or trades. If you, like me, want to become a better investor you should start reading these 5 websites. They have helped me a lot to make the right. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. Pursue your goals with stocks, options, ETFs, mutual funds, and more. Easy-to-use tools. Powerful, intuitive platforms. Trade online, through Power E*TRADE, or. BetterInvesting is a nonprofit organization that has helped over 5M people learn how to invest profitably in stocks of high-quality growth companies. Personally, I've had some good experiences with apps like Robinhood, TD Ameritrade, and E*TRADE. They're user-friendly and offer a variety of. Welcome Money Minds! We put the personal back in personal finance. Learn how to build wealth, become debt free and manage your money. For new investors who just want to put their money to work, it's hard to beat the Acorns investment app. With an intuitive, smart design and no deposit minimums. Investopedia, February Fidelity was named Best Overall online broker, Best Broker for ETFs, and Best Broker for Low Costs, among 25 companies. The. Investors can use smart money management to maximize profits, automate income and expense tracking, and generate financial performance reports on a property and. investment decisions for the world's most important financial We use cookies to optimize site functionality and give you the best possible experience. Some of the top trading platforms in the U.S. include Ally Invest, Robinhood, and Firstrade for beginners, Interactive Brokers, TD Ameritrade, and E*TRADE for. Best Credit Cards · Best Stock Brokers and Trading Platforms · Best CD Rates · Best Mortgage Lenders Use · Privacy Policy · Disclosure Policy · Accessibility.

Latest Laser Hair Removal Machine

When it comes to laser hair removal machines, there are many options. The five most comon types of hair removal laser systems include the Ruby, Alexandrite. Buy Elysion Pro: a premium high powered diode laser hair removal machine with enhanced effectiveness, reducing the time per session as well as number of. The CurrentBody Skin Laser Hair Removal Device has the power of in-clinic laser machines, but with the freedom and convenience of use at home. As the first of. Elite iQ treatments offer quick, easy and customized laser hair removal using smart technology. You can now permanently reduce unwanted hair with a treatment. Most DIY devices do not use an actual laser but intense pulsed light (IPL). Some other hand-held devices use diode lasers. The mechanism is similar to laser. The Candela GentleLASE Pro is designed to work for clients with dark hair and lighter skin, while the GentleYAG Pro works best on a darker skin tone. Permanent. Soprano Titanium is the most advanced laser hair removal device in the market. It is Hair Removal reinvented again by Alma Lasers. Get it for you clinic. 9 results ; Nood The Flasher IPL Permanent Hair Removal ; Braun Silk-expert Pro 5 PL IPL Hair Removal System. Venus Velocity™ is a versatile, easy-to-use diode laser hair removal machine offering fast, comfortable, safe treatments for all skin types. Get info here! When it comes to laser hair removal machines, there are many options. The five most comon types of hair removal laser systems include the Ruby, Alexandrite. Buy Elysion Pro: a premium high powered diode laser hair removal machine with enhanced effectiveness, reducing the time per session as well as number of. The CurrentBody Skin Laser Hair Removal Device has the power of in-clinic laser machines, but with the freedom and convenience of use at home. As the first of. Elite iQ treatments offer quick, easy and customized laser hair removal using smart technology. You can now permanently reduce unwanted hair with a treatment. Most DIY devices do not use an actual laser but intense pulsed light (IPL). Some other hand-held devices use diode lasers. The mechanism is similar to laser. The Candela GentleLASE Pro is designed to work for clients with dark hair and lighter skin, while the GentleYAG Pro works best on a darker skin tone. Permanent. Soprano Titanium is the most advanced laser hair removal device in the market. It is Hair Removal reinvented again by Alma Lasers. Get it for you clinic. 9 results ; Nood The Flasher IPL Permanent Hair Removal ; Braun Silk-expert Pro 5 PL IPL Hair Removal System. Venus Velocity™ is a versatile, easy-to-use diode laser hair removal machine offering fast, comfortable, safe treatments for all skin types. Get info here!

Bestsellers See all · Advanced IPL Hair Removal Machine · IPL/PTF Machine · TOUCHBeauty IPL Hair Removal Device · Laservision Titanium Eye Shield · Laservision F The Braun Silk Expert Pro 3 dry IPL hair removal system provides a perfect solution for effective hair removal and lets $ Our advanced hair removal laser technology safely delivers up to 4X more hair eliminating energy than alternative hair removal devices, leaving your skin. The complete solution for laser hair removal. Multiple Wavelengths, Multiple Modes Treatment is virtually painless, delivering a massage-like sensation. Long-lasting IPL hair removal device with ice-cooling for nearly painless treatment, for facial, bikini & whole body. An independent test was conducted on both Soprano Ice and Primelase HR machines and the Primelase came out on top with 55% more effective hair removal than the. The GentleLase Pro is Candela's newest and most advanced alexandrite laser on the market today and Satori Laser is here to offer the Rolls Royce of laser hair. The only laser hair removal treatment for permanent, full body results outside of a clinic. Reduce hair count by 82% in 8 weeks. Laser, unlike IPL, uses a. The ComplexCity Triple Wavelenghts Diode is one of the most powerful hair removal systems on the market. The handpiece emits a combination of three. DPL (Delicate Pulsed Light) is the latest technology of combining IPL and laser power for permanent hair removal that converts light energy into heat energy. What is Alma's newest device for hair removal? The Soprano Titanium is the latest Alma hair removal device. It incorporates two applicator portals. diode laser hair removal-Vdouble handle *15 years of laser beauty instrument manufacturer, providing professional OEM/ODM beauty machine customization and. Kior's at home laser hair removal device, permanent hair removal machine laser hair removal at home - introducing the latest laser hair removal solution. Nubody equipment is the Canadian manufacturer of the Dermalase IPL laser machine for hair removal / skin rejuvenation. Health Canada approved. If you have hair where you wish you didn't, our laser hair removal Services are for you. We only use the world's best laser hair removal machines at our Clinic. Diode Laser Machine Price in India: ; 1. Diode Laser Hair Removal Laser Machine, ₹ ; 2. Cosderma FDA Approved Diode Laser, ₹ ; 3. Cosderma Diode. Links to the Best Laser Hair Removal Machines we listed in today's Laser Hair Removal Machine review video: 1. Tria Beauty Hair Removal. IPL Laser Hair Removal with Cooling System, Painless Hair Remover, Upgraded to , Flashes, 3 Functions, 9 Energy Levels, Full Body Treatments for Face. Those with light skin and dark hair can opt for an IPL machine, while those with darker skin tone should consider a more versatile laser hair removal machine. Hair Removal Devices · Silk'n 7 Gold · Silk'n 7 Black · Motion Premium · Infinity Fast · Sign up for our newsletter and get 10% off.

Secured Loan Using Car As Collateral

If you want to get a loan using your car as collateral, then you'll likely have to provide your lender with the car's title while you're making loan repayments. Title loans, also known as car title loans or auto title loans, are a type of secured loan where borrowers use their vehicle title as collateral in exchange for. A car title loan is a type of secured loan that allows the borrower to use the title to a vehicle as collateral. A secured car loan is a way to finance a vehicle using the car itself as collateral. Secured loans are less risky for lenders, which means they might come with. The main difference between secured and unsecured personal loans is that borrowers pledge collateral to get secured loans. The collateral acts as security for. A secured auto loan uses collateral — usually the car — as security. Join the finance department at Westbrook Honda for more information about the secured loan. Will deduct % - % from your loan funds as an origination fee; Using your car as collateral can be risky; Car must be fully paid off before it's eligible. A collateral loan is a secured loan that allows you to pledge an asset for availing a loan. This type of loan is relatively risk-free for the. To obtain a title loan, you can pledge your vehicle as collateral, which makes the loan a secured loan. You can potentially use the title of your truck or car. If you want to get a loan using your car as collateral, then you'll likely have to provide your lender with the car's title while you're making loan repayments. Title loans, also known as car title loans or auto title loans, are a type of secured loan where borrowers use their vehicle title as collateral in exchange for. A car title loan is a type of secured loan that allows the borrower to use the title to a vehicle as collateral. A secured car loan is a way to finance a vehicle using the car itself as collateral. Secured loans are less risky for lenders, which means they might come with. The main difference between secured and unsecured personal loans is that borrowers pledge collateral to get secured loans. The collateral acts as security for. A secured auto loan uses collateral — usually the car — as security. Join the finance department at Westbrook Honda for more information about the secured loan. Will deduct % - % from your loan funds as an origination fee; Using your car as collateral can be risky; Car must be fully paid off before it's eligible. A collateral loan is a secured loan that allows you to pledge an asset for availing a loan. This type of loan is relatively risk-free for the. To obtain a title loan, you can pledge your vehicle as collateral, which makes the loan a secured loan. You can potentially use the title of your truck or car.

Most passenger car makes and models can be used as collateral for a personal loan. To qualify, your car must be. COLLATERAL LOANS. Different from an unsecured personal loan or auto loan, a collateral loan allows you to borrow against your vehicle title with no lien. If you own a car or other vehicle, you can use it as collateral for a secured loan. Remember that secured loans borrow against your assets, with vehicles having. A collateral, or secured loan, is guaranteed by something you own. If you fail to repay the loan, you agree to surrender the property securing the loan. To use a car for an auto-secured loan you must own the vehicle with no other lienholders. In addition, the vehicle must have adequate insurance protection. This is is what's called a secured loan since the loan amount is entirely based on the value of the vehicle. Title pawns are another simple, fast way. to access. A secured auto loan uses collateral — usually the car — as security. Join the finance department at Westbrook Honda for more information about the secured loan. If you do not make your loan repayments, the car is forfeited to the lender. The lender then sells the car and pays out the loan with the sale proceeds. Any. Yes, we can provide a loan secured by your personal auto, truck, or motorcycle title. Terms and APR vary depending on the type and age of your vehicle. A secured personal loan is a loan where you are required to provide collateral, such as a title to an ATV, jet ski, snow mobile, tractor; or a KeyBank CD or. You, in theory, could leverage any equity you have in the vehicle into more debt. So, like, if the car is worth 20k and your loan is $15k. However, those buying an older or damaged used vehicle may prefer an unsecured auto loan. A secured auto loan uses the car you are purchasing as collateral. Secured personal loans that use your car as collateral are also known as auto equity loans, and many lenders require you to own the car free and clear before. A secured collateral loan requires that the borrower use their assets (such as a car, house or savings account) as collateral to “secure” the loan. The. Unlike unsecured personal loans, car loans are always secured. The car you buy is the collateral. This is one reason that auto loans usually come with lower. In a nutshell · You may be able to use your car as collateral for a logbook loan, depending on the lender's criteria · Logbook loans can be more expensive and. All secured loans require collateral. For example, when you take out an auto loan, the car is used to secure the loan. The car is the collateral. Similarly. A collateral loan — also called a secured loan — is backed by something you own. The item that backs the loan is called collateral. The lender has the right to. There are two main types of collateral that can be used as security for personal loans: vehicles, and savings accounts. Some lenders will accept vehicles as. This is is what's called a secured loan since the loan amount is entirely based on the value of the vehicle. Title pawns are another simple, fast way. to access.

Employer 401k Match Explained

Many retirement plans, such as SIMPLE IRAs and (k)s, provide that your employer will match some portion of the amount you contribute to your retirement. If you have an annual salary of $, and contribute 6%, your contribution will be $6, and your employer's 50% match will be $3, ($6, x 50%), for a. Matching (k) contributions are the additional contributions made by employers, on top of the contributions made by employees. Your employer might match your contributions to your (k). The employer match helps you accelerate your retirement contributions. For every dollar you. An employer match is when your employer contributes a certain amount to your retirement savings plan based on how much you contribute. (k) employer matching is the process by which an employer contributes to an employee's retirement account based on the employee's contributions. A match is free money your employer adds to your (k) based on your personal contributions, up to a certain amount. The k match can be anything from zero, no match at all, to a nearly % match. Typically you will see something around a 3% match. That's generally how it. If an employee contributes to their employer-matching (k) program, employers will match this contribution up to a certain amount. Put simply, a (k) match. Many retirement plans, such as SIMPLE IRAs and (k)s, provide that your employer will match some portion of the amount you contribute to your retirement. If you have an annual salary of $, and contribute 6%, your contribution will be $6, and your employer's 50% match will be $3, ($6, x 50%), for a. Matching (k) contributions are the additional contributions made by employers, on top of the contributions made by employees. Your employer might match your contributions to your (k). The employer match helps you accelerate your retirement contributions. For every dollar you. An employer match is when your employer contributes a certain amount to your retirement savings plan based on how much you contribute. (k) employer matching is the process by which an employer contributes to an employee's retirement account based on the employee's contributions. A match is free money your employer adds to your (k) based on your personal contributions, up to a certain amount. The k match can be anything from zero, no match at all, to a nearly % match. Typically you will see something around a 3% match. That's generally how it. If an employee contributes to their employer-matching (k) program, employers will match this contribution up to a certain amount. Put simply, a (k) match.

Employees benefit by getting “free money” in the form of the matching contribution, which incentivizes them to save more. They're also immediately vested in the. Often, this match is 50 cents or $1 for each dollar your employee contributes. There is also often a cap on the amount the employer will match, such as 6% of. In many cases, individuals feel they can't “afford” to make contributions, but if the company matches dollar-for-dollar, then that's the equivalent of an. Business owners who offer a traditional k have the flexibility to contribute the same amount to all participating employees, match individual contribution. Usually an employer match percentage tells you what % of the salary they will match - not what % of your k contribution they will match. For. Matching (k) contributions are the additional contributions made by employers, on top of the contributions made by employees. Let's say you work for an employer who matches your (k) contributions dollar-for-dollar up to 6% of your $45, salary. If you save the full 6%, the company. (k) employer matching is the process by which an employer contributes to an employee's retirement account based on the employee's contributions. Lots of defined contribution plans come with a bonus: a matching contribution from your company. The match can often be 50 cents to a dollar for every. Most employers match employees' contributions each payday when employees receive their paycheck. Some employers may also make a single lump-sum payment at year. To make payroll deductions for retirement savings more appealing, employers sometimes offer to match the contributions their employees make. These matching. The most common (k) matching contribution is an employer contribution of 50 cents for each dollar an employee contributes, up to 6% of the employee's pay. If your employer offers partial matching, it will match part of the money you put in to a (k) account, up to a specific limit. Most employers provide a 50%. If your employer offers partial matching, it will match part of the money you put in to a (k) account, up to a specific limit. Most employers provide a 50%. Typically, employers will match a percentage of your contribution up to a certain amount, as explained above. employer offers a 6% full Roth (k) employer. If you're able, meeting your company match is generally a good idea. There's a reason a (k) match is often referred to as “free money.” You don't have to do. The most common form of contribution is a match, meaning the business owner is only responsible for making a contribution when the employee does so. An Employee Stock Ownership Plan (ESOP) is a form of defined contribution plan in which the investments are primarily in employer stock. A Cash Balance Plan is. A true-up is an additional, end-of-year matching contribution made by an employer to an employee's (k) account. Learn why it happens. Let's say you work for an employer who matches your (k) contributions dollar-for-dollar up to 6% of your $45, salary. If you save the full 6%, the company.

Best Wifi Router For 50 Mbps Speed

It has a high-speed antenna, which allows for wireless connectivity with all built-in connectivity, and so such as a pacemaker. 50 mBps router has a Wi-Fi. Good speed for HD streaming & video conferencing. Up to Mbps† Download; Up Up to 50 Mbps† Upload; Downstream Monthly Usage Allowance: Unlimited. "best router for comcast blast 50mbps" · TP-Link - Archer AX20 AX Dual-Band Wi-Fi 6 Router - Black · ARRIS - SURFboard 24 x 8 DOCSIS Also, you may want to check if there are other wireless devices near your Google Nest Wifi router such as Microwave, Cordless Phone, Wireless speakers. Check your internet availability for T-Mobile's fast, in-home 5G internet by address. We're working hard to deliver our 5G internet across the country. Mbps, while 5 GHz Wi-Fi will support up to Mbps. But be careful! The maximum speed dependent on what wireless standard a router supports — b. The Ghz band on my brand new AX router is maxing out at 50Mbps download on my cellphone. However, if I connect that same phone to the 5Ghz band it maxes. All around, the TP-Link Archer AX55 is a great performer. It outperformed most of the WiFi routers across many of our test metrics, including our GHz speed. NETGEAR Nighthawk X6 Smart Wi-Fi Router (R) - AC Tri-band Wireless Speed (Up to Mbps) | Up to Sq Ft Coverage & 50 Devices | 4 x 1G Ethernet. It has a high-speed antenna, which allows for wireless connectivity with all built-in connectivity, and so such as a pacemaker. 50 mBps router has a Wi-Fi. Good speed for HD streaming & video conferencing. Up to Mbps† Download; Up Up to 50 Mbps† Upload; Downstream Monthly Usage Allowance: Unlimited. "best router for comcast blast 50mbps" · TP-Link - Archer AX20 AX Dual-Band Wi-Fi 6 Router - Black · ARRIS - SURFboard 24 x 8 DOCSIS Also, you may want to check if there are other wireless devices near your Google Nest Wifi router such as Microwave, Cordless Phone, Wireless speakers. Check your internet availability for T-Mobile's fast, in-home 5G internet by address. We're working hard to deliver our 5G internet across the country. Mbps, while 5 GHz Wi-Fi will support up to Mbps. But be careful! The maximum speed dependent on what wireless standard a router supports — b. The Ghz band on my brand new AX router is maxing out at 50Mbps download on my cellphone. However, if I connect that same phone to the 5Ghz band it maxes. All around, the TP-Link Archer AX55 is a great performer. It outperformed most of the WiFi routers across many of our test metrics, including our GHz speed. NETGEAR Nighthawk X6 Smart Wi-Fi Router (R) - AC Tri-band Wireless Speed (Up to Mbps) | Up to Sq Ft Coverage & 50 Devices | 4 x 1G Ethernet.

Stronger, faster, more stable WiFi starts with Nighthawk WiFi routers. Choose from a range of options to fit the size of your home and speed of your internet. It has a high-speed antenna, which allows for wireless connectivity with all built-in connectivity, and so such as a pacemaker. 50 mBps router has a Wi-Fi. Everyone wants reliable and fast internet, and a good router can help. The trick is to work out how the complicated mess of standards, confusing acronyms. Change your WiFi router and your device to something that can provide you Mbps, which is quite high for WiFi. Our Top Tested Picks · TP-Link Archer AX21 AX Dual-Band Wi-Fi 6 Router · Reyee RG-E5 Wi-Fi 6 Router · TP-Link Archer C7 AC Wireless Dual Band Gigabit. Dual-band router: These wireless routers use and 5 GHz frequencies. Dual-band can support faster internet speeds than single-band routers and can manage. Customer Also Bought · 5G/4G Mobile Sim Router | Triple Antenna, Mbps Speed, Plug & · AUSHA 4G LTE Wireless WiFi Modem Router | Mbps Dongle | Connects. If you have 50 Mbps internet connection there is no need to buy 5Ghz or dual-band routers. So I have Mbps connection of excitel and I was always skeptical. TP-Link Archer AX50 · WiFi 6 Technology · 3 Gbps Speed ( Mbps on 5 GHz band and Mbps on GHz band) · Dual-Band · Connect 40+ devices · Easy Setup with the. What's a good internet speed? As a rule of thumb, most people need Mbps download speeds to easily cover streaming, gaming, and internet browsing all at. 50+ Mbps Internet Speed from Your ISP. Smooth 4K and 8K. Non-Stop Entertainment. Best for 8K Streaming. Best for 8K Streaming Router. Archer AX90NEW. AX Tri. Reyee RG-E5 for $ Based purely on performance, this dual-band, Wi-Fi 6 router impressed me. It offered great coverage, very fast speeds on the 5-GHz band. Don't worry, I am here to help you find the best router for 50 Mbps internet connection. As network professionals every day we are dealing with network. CP PLUS CP-XR-DES Mbps 4G Router. 3, ₹2, ; Telehatch 4G/3G High Speed INTERNET WiFi Router with Outdoor Antenna Mbps 4G Router. 9, ₹6, Routers · TP-LINK 4G+ Cat6 AC Wireless Dual Band Gigabit Router Archer MR (ArcherMR) · TP-LINK 5G AX Wireless Dual-Band Gigabit Router Archer NX 50 Mbps refers to the modem's internet speed. 50 Mbps can support three How to Connect a Linksys Wireless Router to Qwest High-Speed Internet · What. The best WiFi router is the one that can deliver the full bandwidth of your Internet speed tier and handle all of the WiFi devices in your business or household. Routers · TP Link Archer C50 AC Dual Band Wireless Cable Router, Wi Fi Speed Up to · TP Link TL WRN Mbps Speed Wireless WiFi Router, Easy Setup, IPv6. Fast (Mbps) Refine by Speed: Fast (Mbps). WiFi Coverage. 2, MR Tri-Band AXE Mesh WiFi 6E Router. Best Seller. Find a Retailer. It has Multi-user, multiple-input, multiple-output technology or MU-MIMO and this is a wifi game changer. With this tech, your $50 Rock Space router can.

1 2 3 4 5