ostashkovadm.ru

Learn

Gnr Etf Price

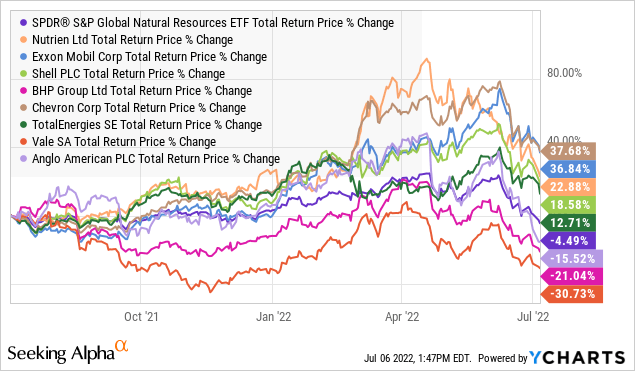

SPDR S&P Global Natural Resources ETF. Price: $ Change: $ (%). Category. Discover GNR stock price history and comprehensive historical data for the SPDR S&P Global Natural Resources ETF, including closing prices, opening values. SPDR® S&P Global Natural Resources ETF GNR · NAV. · Open Price. · Bid / Ask / Spread. / / % · Volume / Avg. k / k · Day Range. What is the highest and lowest price SPDR S&P Global Natural Resources ETF traded in the last 3 year period? In the last 3 years, GNR stock traded as high as. Is SPDR® S&P Global Natural Resources ETF (NYSEARCA:GNR) a buy? Compare the latest price, visualised quantitative ratios, annual reports. The GNR Exchange Traded Fund (ETF) is provided by SPDR. It is built to track an index: S&P Global Natural Resources Index. The GNR ETF provides physical. Find the latest quotes for SPDR S&P Global Natural Resources ETF (GNR) as well as ETF details, charts and news at ostashkovadm.ru SPDR® S&P Global Natural Resources ETF GNR:NYSE Arca ; $, (%) ; As of pm ET 08/07/ Discover historical prices for GNR stock on Yahoo Finance. View daily, weekly or monthly format back to when SPDR S&P Global Natural Resources ETF stock was. SPDR S&P Global Natural Resources ETF. Price: $ Change: $ (%). Category. Discover GNR stock price history and comprehensive historical data for the SPDR S&P Global Natural Resources ETF, including closing prices, opening values. SPDR® S&P Global Natural Resources ETF GNR · NAV. · Open Price. · Bid / Ask / Spread. / / % · Volume / Avg. k / k · Day Range. What is the highest and lowest price SPDR S&P Global Natural Resources ETF traded in the last 3 year period? In the last 3 years, GNR stock traded as high as. Is SPDR® S&P Global Natural Resources ETF (NYSEARCA:GNR) a buy? Compare the latest price, visualised quantitative ratios, annual reports. The GNR Exchange Traded Fund (ETF) is provided by SPDR. It is built to track an index: S&P Global Natural Resources Index. The GNR ETF provides physical. Find the latest quotes for SPDR S&P Global Natural Resources ETF (GNR) as well as ETF details, charts and news at ostashkovadm.ru SPDR® S&P Global Natural Resources ETF GNR:NYSE Arca ; $, (%) ; As of pm ET 08/07/ Discover historical prices for GNR stock on Yahoo Finance. View daily, weekly or monthly format back to when SPDR S&P Global Natural Resources ETF stock was.

FlexShs Morningstar Glbl Upsteam Ntrl Res Idx Fd. $ GUNR % ; First Trust Indxx Global Natural Resources Inc ETF. $ FTRI % ; SPDR S&P North. The SPDR S&P Global Natural Resources ETF (GNR) is an exchange-traded fund that is based on the S&P Global Natural Resources index. Spdr S&p Global Natural Resources Etf share price live: GNR Live stock price with charts, valuation, financials, price target & latest insights. Fund Market Price as of ; Exchange Volume (Shares). Exchange Volume (shares). Represents the volume of shares traded on the ETF's primary exchange. GNR SPDR S&P Global Natural Resources ETF. $ (%). Closed. [NYSEArca]. B. Add to Portfolio. Share Fund. SPDR S&P Global Natural Resources ETF ETF holdings by MarketWatch. View complete GNR exchange traded fund holdings for better informed ETF trading. SPDR® S&P Global Natural Resources ETF (GNR). + (+%) USD | NYSEARCA | May. GNR ETF FAQ · What was GNR's price range in the past 12 months? GNR lowest ETF price was $ and its highest was $ in the past 12 months. · What is the. GNR - SPDR S&P Global Natural Resources ETF - Stock screener for investors and traders, financial visualizations. ETF funds overview by Barron's. View the GNR funds market news. Personalize and monitor market data with your custom tool. Register Now. SymbolPrice/Vol%Chg. View the latest SPDR S&P Global Natural Resources ETF (GNR) stock price and news, and other vital information for better exchange traded fund investing. The SPDR S&P Global Natural Resources ETF seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield. Based on 92 Wall Street analysts offering 12 month price targets to GNR holdings in the last 3 months. The average price target is $ with a high forecast. Key Turning Points ; 1st Resistance Point, ; Last Price, ; 1st Support Level, ; 2nd Support Level, ; 3rd Support Level, Latest SPDR S&P Global Natural Resources ETF (GNR) stock price, holdings, dividend yield, charts and performance. An easy way to get SPDR S&P Global Natural Resources ETF real-time prices. View live GNR stock fund chart, financials, and market news. SPDR S&P Global Natural Resources ETF (GNR): Price and Financial Metrics ETF · SPDR S&P Global Natural Resources ETF (GNR): $ · Get Rating · Component Grades. Real-time Price Updates for S&P Global Natural Resources SPDR (GNR-A) Hamilton ETFs -- HBND: Canada's First Covered Call Bond ETF. August 14, The GNR stock price today is What Stock Exchange Is GNR Traded On? GNR is listed and trades on the NYSE stock exchange. Is GNR a Good ETF to Buy? Looking to buy GNR ETF? View today's GNR ETF price, trade commission-free, and discuss SPDR S&P Global Natural Resources ETF updates with the investor.

How To Take Money Out Of 401k Without Paying Taxes

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Many (k) plans allow you to withdraw money before you actually retire to pay for certain events that cause you a financial hardship. If you leave your job or retire, you may be able to withdraw funds without penalty — even if you're under retirement age. If, however, you are still employed. A withdrawal permanently removes money from your retirement savings for your immediate use, but you'll have to pay extra taxes and possible penalties. Let's. As per the rule participant may begin to withdraw money from their (K) once he or she reaches the age of 59 1/2 without paying 10% early withdrawal penalty. Also, depending on the type of plan the funds are withdrawn from, you may have a 10% penalty tax as well ( plans are not subject to the 10% early withdrawal. Usually, if one withdraws money from a (k) or IRA before age 59 1/2, they will pay a 10% penalty and taxes on the withdrawal. But, the 10% penalty does not. Key Takeaways · One of the easiest ways to lower the amount of taxes you have to pay on (k) withdrawals is to convert to a Roth IRA or Roth (k). Before reaching retirement age, participants in some (k) plans are permitted to withdraw funds from their account as loans. An employee may need to meet. A loan from your (k) instead of withdrawing money avoids taxable income. How Distributions Are Taxed. Distributions from your (k) are taxed as ordinary. Many (k) plans allow you to withdraw money before you actually retire to pay for certain events that cause you a financial hardship. If you leave your job or retire, you may be able to withdraw funds without penalty — even if you're under retirement age. If, however, you are still employed. A withdrawal permanently removes money from your retirement savings for your immediate use, but you'll have to pay extra taxes and possible penalties. Let's. As per the rule participant may begin to withdraw money from their (K) once he or she reaches the age of 59 1/2 without paying 10% early withdrawal penalty. Also, depending on the type of plan the funds are withdrawn from, you may have a 10% penalty tax as well ( plans are not subject to the 10% early withdrawal. Usually, if one withdraws money from a (k) or IRA before age 59 1/2, they will pay a 10% penalty and taxes on the withdrawal. But, the 10% penalty does not. Key Takeaways · One of the easiest ways to lower the amount of taxes you have to pay on (k) withdrawals is to convert to a Roth IRA or Roth (k). Before reaching retirement age, participants in some (k) plans are permitted to withdraw funds from their account as loans. An employee may need to meet. A loan from your (k) instead of withdrawing money avoids taxable income. How Distributions Are Taxed. Distributions from your (k) are taxed as ordinary.

If you withdraw from an IRA or (k) before age 59½, you'll be subject to an early withdrawal penalty of 10% and taxed at ordinary income tax rates. · There are. Your payer must withhold at a default 10% rate from the taxable amount of nonperiodic payments unless you enter a different rate. Distributions from an IRA that. Basically, any amount you withdraw from your (k) account has taxes withheld at 20%, and if you're under age 59½, you'll be taxed an additional 10% when you. Hardship withdrawals are generally subject to federal (and possibly state) income tax. A 10% federal penalty tax may also apply if you're under age 59½. [If you. Individuals must pay an additional 10% early withdrawal tax unless an exception applies. Exceptions to the 10% additional tax. Exception, The distribution will. The only other way to withdraw money early from a (k) without paying the 10 percent penalty is through IRS rule 72(t), which allows you to deduct a fixed. If you take a non-qualified withdrawal of your Roth (k) contributions, any Roth (k) investment returns are subject to regular income taxes, plus a. In addition, the benefit to utilizing a traditional k is that you get to set aside money on a pre-tax basis. If you borrow a k loan, you pay yourself back. You'll pay income taxes when making a hardship withdrawal and potentially the 10% early withdrawal fee if you withdraw before age 59½. However, the 10% penalty. Consider Roth Contributions · Stay in a lower tax bracket · Borrow Instead of Withdrawing from a (k) · Avoid Early Withdrawal Penalty · Defer Taking Social. If you want access to your money without paying taxes first, you can roll your (k) balance over to an IRA before taking a distribution. With IRAs, you have. Technically you need to be at least 59 1/2 before you can take penalty-free withdrawals from your (k). But there are exceptions where you may be able to. You will still need to pay the income tax on the withdrawal, but it could be possible to avoid the 10% early withdrawal penalty fee. The main exceptions for. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. Unfortunately, there's usually a 10% penalty—on top of the taxes you owe—when you withdraw money early. This is where the rule of 55 comes in. If you turn 55 . Depending on the amount you withdraw and where you live, you may need to pay state or local taxes as well. If you tap into your (k) before you reach age 59½. Disadvantages of Closing Your k · The IRS levies a 10% penalty. · The money you withdraw is treated as taxable income, potentially at a higher tax rate. · The. You can take money from your (k) account if you are age 59½ or older. You will not have a penalty. Twenty percent is withheld for federal income taxes. You. One way to take distributions from a roth IRA without penalty is using the 72(t) rule. The 72(t) rule allows penalty-free withdrawals from IRA.

Credit Card Reader Lowest Rate

When choosing a credit card machine, businesses should consider: Cost of the machine and processing fees. Compatibility with their current systems. Security. Home / Vending Machine Parts / New Credit Card Readers. New Credit Card Sort by price: high to low. Cantaloupe G11 Credit Card Reader. Free Install. Helcim saves you 25% on in-person and online credit card payments with no hidden fees, no monthly fees, and no contracts. Get started for free. First Data FD Terminal with WIFI P/N Model FD Description The FD Terminal allows you to accept payments quickly and gets you ready for. Tap & Chip Card Reader with Dock - POS Countertop Wireless Credit Card Reader Device + Holder Stand - Contactless Payment Point of Sale Station for Retail. For low and simple fees, a free and easy-to-set-up reader, and funding as fast as one day, Square is the best overall choice for small businesses that need a. Best card reader for businesses on a budget Its OmniChannel plan is priced at $ per month if you pay annually. eHopper's surcharging and cash discount. People often viewed · T Square - Terminal - White · F Square - Reader for contactless and chip (2nd generation) · F IOGEAR - USB CAC Reader · F. The lowest rate you can get is % + $ on debit cards and % + $ on Visa because that's what the card brands charge. Ever. When choosing a credit card machine, businesses should consider: Cost of the machine and processing fees. Compatibility with their current systems. Security. Home / Vending Machine Parts / New Credit Card Readers. New Credit Card Sort by price: high to low. Cantaloupe G11 Credit Card Reader. Free Install. Helcim saves you 25% on in-person and online credit card payments with no hidden fees, no monthly fees, and no contracts. Get started for free. First Data FD Terminal with WIFI P/N Model FD Description The FD Terminal allows you to accept payments quickly and gets you ready for. Tap & Chip Card Reader with Dock - POS Countertop Wireless Credit Card Reader Device + Holder Stand - Contactless Payment Point of Sale Station for Retail. For low and simple fees, a free and easy-to-set-up reader, and funding as fast as one day, Square is the best overall choice for small businesses that need a. Best card reader for businesses on a budget Its OmniChannel plan is priced at $ per month if you pay annually. eHopper's surcharging and cash discount. People often viewed · T Square - Terminal - White · F Square - Reader for contactless and chip (2nd generation) · F IOGEAR - USB CAC Reader · F. The lowest rate you can get is % + $ on debit cards and % + $ on Visa because that's what the card brands charge. Ever.

Free Square Reader for magstripe. Early termination. Processing refunds. Credit card fees are included in Square's fees, so there are no charges from credit. For low and simple fees, a free and easy-to-set-up reader, and funding as fast as one day, Square is the best overall choice for small businesses that need a. credit card reader companies comes in the form of cost or transaction fees. The costs associated with credit card readers include hardware cost, equipment. The PAX A is the most beautiful touch-screen credit card terminal on the market. It comes with the speed and processing power of a high-end smartphone but in. Pay % + 10¢ per swipe for Visa, Mastercard, Discover, and American Express. Get your money as fast as the next business day. Learn more about Square Payments. The Square Terminal is one of the lower-priced all-inclusive card readers. Couple affordable hardware with a fee-free software plan option, and Square makes. We offer low rates and a free credit card machine with our merchant accounts. Secondly, there are no application or setup fees. What are the Best Credit Card Reader & Terminal Options? ecommerce, shopping, credit card. Small business owners have many options for credit card readers. Low rates for all card types, including American Express, and no monthly fees. Icon - 40sq - wifi x2. Wi-Fi and SIM. Stay connected when you're. The use of electronic card readers added a layer of complexity (and new credit card fees) However, the convenience of swipe payments didn't come without a cost. Price for a credit card terminal or reader: The Square Reader for contactless and chip payments costs $49, while the Square Terminal countertop device starts at. This varies by processor, however, most rates range from 2% to % per transaction, while the per-transaction fees can range anywhere from $ to $ per. Monthly fees are charges that businesses pay regularly to the payment processor or merchant services provider to maintain access to the credit card reader's. GoDaddy Payments offers the lowest transaction fees compared to other leading providers.* We stick up for your small business and save you money. % + 0¢. What are the Best Credit Card Readers at Staples? · MAGTEK® Dynamag Magnetic Stripe Reader · Square Terminal HandHeld Wi-Fi/Ethernet. Credit Card Reader(20) ; current price $ ; current price $ ; current price $ ; current price $ ; current price Now $ Credit Card Readers · Best Match · Brand A - Z · Brand Z - A · Most Reviews · Price Lo - Hi · Price Hi - Lo · Top Rated. - There are monthly service fees associated with operating a card reader in your vending machine. Fees are as low as $ per month + a small fee per. A credit card reader that charges no hidden fees and can easily be taken on the go was once unheard of. Now, small business owners have the option to take. Best credit card readers · Square: Best square readers for beginners. · Lightspeed: Best card reader for established retail and restaurant businesses. · eHopper.

Sentinelx Nfc

12x Rewards, or 10% Boost Earn 12x rewards on a Basic COIN Plan, and a 10% boost on any COIN Premium Plan! The SentinelX NFC requires no battery. Instead of connecting with Bluetooth like the SentinelX BLE it uses the NFC Chip to sync with the Coin App. If you have a newer phone (last years) you only. Official XYO NFC SENTINELX, COIN APP ×12CRYPTO GEOMINING - UNSHARED. Shop for the XYO COIN App Sentinel X NFC 12X Mine at Ubuy UK and enjoy free shipping. Get your hands on this sealed XYO COIN with advanced mining. When I started to use it first time I use it with a free basic account and without a sentinelX NFC card or sentinelx BLE bluetooth keychain. So my geomines. SentinelX NFC Device Review - Is it worth it? Christian Rauchenwald · · SentinelX BLE Review (vs. NFC) - COIN App SentinelX BLE. Christian. XYO Coin Network | Hey, how many times i can scan sentinelX NFC Hey, how many times i can scan sentinelX NFC? because there is writhen scan. Get the brand new XYO COIN App Sentinel X NFC 12X Mine Boost Card at Ubuy Kosovo. Unregistered and crypto-compatible for mining success. The SentinelX NFC is a small plastic card that works alongside the Coin App. Its purpose is to add an extra layer of verification to your data. Since the Coin. 12x Rewards, or 10% Boost Earn 12x rewards on a Basic COIN Plan, and a 10% boost on any COIN Premium Plan! The SentinelX NFC requires no battery. Instead of connecting with Bluetooth like the SentinelX BLE it uses the NFC Chip to sync with the Coin App. If you have a newer phone (last years) you only. Official XYO NFC SENTINELX, COIN APP ×12CRYPTO GEOMINING - UNSHARED. Shop for the XYO COIN App Sentinel X NFC 12X Mine at Ubuy UK and enjoy free shipping. Get your hands on this sealed XYO COIN with advanced mining. When I started to use it first time I use it with a free basic account and without a sentinelX NFC card or sentinelx BLE bluetooth keychain. So my geomines. SentinelX NFC Device Review - Is it worth it? Christian Rauchenwald · · SentinelX BLE Review (vs. NFC) - COIN App SentinelX BLE. Christian. XYO Coin Network | Hey, how many times i can scan sentinelX NFC Hey, how many times i can scan sentinelX NFC? because there is writhen scan. Get the brand new XYO COIN App Sentinel X NFC 12X Mine Boost Card at Ubuy Kosovo. Unregistered and crypto-compatible for mining success. The SentinelX NFC is a small plastic card that works alongside the Coin App. Its purpose is to add an extra layer of verification to your data. Since the Coin.

SentinelX NFC is small versatile device, don't underestimate the rewards that this NFC card is capable of. Get your NFC today and start. Buy SentinelX NFC XYO geomining in Singapore,Singapore. Geomining with the COIN app Another fun, useful and potentially lucrative use of sentinels including. SentinelX NFC is a credit card-sized device that utilizes near-field-communication (NFC) technology to provide a temporary 12 times boost on your geomining. If you have the SentinelX NFC card you know just as well as I do that it is a pain to pull that card out of your wallet every time you want. Simply tap this card on an NFC-enabled device to access services, make payments, or gain entry to restricted areas. The card supports a range of functionalities. COIN App Sentinel X NFC 12X Earning Rewards Crypto Currency. $5. $ Last updated 4 months ago in San Francisco, CA. Condition: Used (normal wear). Get the brand new XYO COIN App Sentinel X NFC 12X Mine Boost Card at Ubuy Zambia. Unregistered and crypto-compatible for mining success. Selling 1 new XYO SentinelX NFCDownload the coin app. Start mining XYO tokens immediately once you receive the sentinel and you'll get 12x rewards. SentinelX NFC looks like a credit card that you scan with the COIN app on your smart phone every 4 hours SentinelX BLE is a small hexagon thingie that is. likes, 6 comments - coinappstore on April 27, "Take your SentinelX NFC anywhere without having the worry of running out of battery ". The SentinelX NFC is a card that uses Near-field Communication technology to help us verify your location is authentic and activates the same SentinelX. sentinelx nfc · Sentinel X BLE Device Coin App Crypto XYO Geomining Miner And NFC Card Sentinelx. NEW Official XYO NFC SentinelX, COIN App x12 Crypto Geomining - Unshared. trailerp22 (); % positive Feedback. Approx. £ US $ or Best Offer. The document provides instructions for setting up a COIN account and using the SentinelX NFC device to earn additional rewards through the COIN app. Users. Want a SentinelX NFC? Check out COIN's Store: ostashkovadm.ru · Home; SentinelX. SentinelX. There are no products listed under this. Water Drop. Buy Now. SentinelX NFC · $ SentinelX NFC. Buy Now. Lime Slice · $ Lime Slice. Buy Now. JAKCOM R5 Smart Ring Nice than sentinelx nfc device xyo interruptor con protector t rewritable sticker magic chinese card. Free shipping · JAKCOM R5 Smart. Sentinel X NFC Online, 60% Discount, ostashkovadm.ru Two notable devices within this group are SentinelX BLE and SentinelX NFC. The former is a compact, portable device that boosts geomining.

How To Transfer Money From Inr To Usd

Step by step guide to transfer money to USA from India · Step 1 - Create your account with the chosen remittance company. · Step 2 - Provision the manner in which. Convert Indian Rupee to US Dollar ; INR, USD ; INR, USD ; 1, INR, USD ; 5, INR, USD. Step One Fill Sender's & beneficiary's details, money transfer purpose, requirement to confirm your eligibility. · Step Two Upload the required documents online. ostashkovadm.ru facilitates Wire transfer from India in 16+ currencies, including USD, EUR, GBP, AUD, CAD, ostashkovadm.ru others, through worldwide Correspondent. CurrencyFair can be a cheap international money transfer service with quick delivery times on many currency routes. There's a low, flat fee per transfer, and. Money transfer to India request can be initiated by our account holders over the counter or by mailing us original RMT 2I form or through Online Banking. Max out Transfer using Wise, Remitly and Xe. Remaining use any option that you mentioned. See if your parents can also open account and send remaining balance. For cost-effective money transfers from India to US, consider options like Wise (formerly TransferWise) or Xoom. As an Admissify financial. Make a money transfer from India to the USA with Western Union today. Support your loved ones by sending money online or at an agent location near you. Step by step guide to transfer money to USA from India · Step 1 - Create your account with the chosen remittance company. · Step 2 - Provision the manner in which. Convert Indian Rupee to US Dollar ; INR, USD ; INR, USD ; 1, INR, USD ; 5, INR, USD. Step One Fill Sender's & beneficiary's details, money transfer purpose, requirement to confirm your eligibility. · Step Two Upload the required documents online. ostashkovadm.ru facilitates Wire transfer from India in 16+ currencies, including USD, EUR, GBP, AUD, CAD, ostashkovadm.ru others, through worldwide Correspondent. CurrencyFair can be a cheap international money transfer service with quick delivery times on many currency routes. There's a low, flat fee per transfer, and. Money transfer to India request can be initiated by our account holders over the counter or by mailing us original RMT 2I form or through Online Banking. Max out Transfer using Wise, Remitly and Xe. Remaining use any option that you mentioned. See if your parents can also open account and send remaining balance. For cost-effective money transfers from India to US, consider options like Wise (formerly TransferWise) or Xoom. As an Admissify financial. Make a money transfer from India to the USA with Western Union today. Support your loved ones by sending money online or at an agent location near you.

Enter the amount in USD you need to transfer, the purpose of remittance and click on 'get rates'. · Compare rates from banks & RBI approved exchange houses. · You. How to Transfer money from India to USA? · Navigate to your web portal. · Log in with the credentials or register as a new user. · Choose the service you need. Get the latest USD to INR exchange rates with SBI California for money transfers to India. Enjoy competitive rates and ensure your transfers are. The Mid-Market and Exchange Rates: The current mid-market for INR-USD is USD per Indian Rupee. · Fees: When sending money you may have to pay fees. Send money to USA from India online securely & conveniently. Axis Bank's outward remittance lets you remit money through reliable & quick transactions. You need the recipient's name, address and bank information, including SWIFT code and account number. · You can send in U.S. dollars or foreign currency; cutoff. Convert Indian Rupee to US Dollar ; INR, USD ; INR, USD ; 1, INR, USD ; 5, INR, USD. The cheapest way to send money from India to the USA is through an online provider. Among the 5 available, Instarem was most often the cheapest provider (in. Transfer money anywhere in the world with ease with Instarem, where competitive exchange rates and low fees come standard. Choose us for seamless transactions. Today's conversion rate of the INR to the US Dollar is 1 INR = Dollars. Within the last 30 days, this conversion rate went high to while it was. Best ways to send money to the USA from abroad · Bank Transfer. Bank transfers are usually the cheapest option when it comes to funding your international money. (INR to USD) Get the best exchange rate to transfer money from India to USA (Indian rupees to Us dollars). Receive 0 Us dollars in exchange of Indian. Users are requested to note the exchange rate of USD to INR as displayed on the website. In order to send remittances, open a Checking/Money Market Deposit. XE, the cheapest option, has a Canadian Dollar/Indian Rupee exchange rate of and a fee of CAD. This would save you CAD compared to OFX, who. 1. Start your transfer. Choose how much you want to send in Indian Rupees, and pick India as your destination country · 2. Get transparent rates. Enjoy. Enter your payment information and select confirm transfer to send. Send money worldwide. Remitly gives you options. Ria offers more ways to send and receive money. With a network of locations across India, you can choose between cash pickup or bank deposit. Discover top online providers offering money transfer to India with the best 1 USD to INR exchange rate, lowest fees, fastest transfer times, and special. How much do you want to send for UPI transfer, bank deposit or cash pickup? Start Saving Today! Get Better Exchange Rates when sending $+ USD to India. $0. The Mid-Market and Exchange Rates: The current mid-market for INR-USD is USD per Indian Rupee. · Fees: When sending money you may have to pay fees.

Ssl Certificate Issuers

Let's Encrypt is a free, automated, and open certificate authority brought to you by the nonprofit Internet Security Research Group (ISRG). Read all about our. Your encryption comes with a Site Seal to display on your website, from the world's largest Certificate Authority. This, and the browser padlock, shows your. To determine the Certificate Authority that issued your certificate, open the website in a browser and click on the certificate information. Our SSL Certificates offer top-tier security for businesses of all sizes, fostering trust online and earning favor with Google's ranking algorithms. Secure your site with an SSL certificate from the world's largest commercial certificate authority Regulations have changed for Code Signing. Purchase a GlobalSign is the SSL certificate provider of choice for large organizations with complex needs. They have some of the highest rates in the industry, but also. We provide affordable and flexible TLS/SSL certificates to a wide variety of businesses and organizations to reliably secure websites, servers and digital. Websites use certificates to create an HTTPS connection. When signed by a trusted certificate authority (CA), certificates give confidence to browsers that. A certificate authority or certification authority (CA) is an entity that stores, signs, and issues digital certificates. Let's Encrypt is a free, automated, and open certificate authority brought to you by the nonprofit Internet Security Research Group (ISRG). Read all about our. Your encryption comes with a Site Seal to display on your website, from the world's largest Certificate Authority. This, and the browser padlock, shows your. To determine the Certificate Authority that issued your certificate, open the website in a browser and click on the certificate information. Our SSL Certificates offer top-tier security for businesses of all sizes, fostering trust online and earning favor with Google's ranking algorithms. Secure your site with an SSL certificate from the world's largest commercial certificate authority Regulations have changed for Code Signing. Purchase a GlobalSign is the SSL certificate provider of choice for large organizations with complex needs. They have some of the highest rates in the industry, but also. We provide affordable and flexible TLS/SSL certificates to a wide variety of businesses and organizations to reliably secure websites, servers and digital. Websites use certificates to create an HTTPS connection. When signed by a trusted certificate authority (CA), certificates give confidence to browsers that. A certificate authority or certification authority (CA) is an entity that stores, signs, and issues digital certificates.

SSL certificate is also used with TLS protocol, an enhanced security protocol used in SSL by most modern browsers and sites. Every connection made to a TLS/SSL-. SSL Certificate Authorities in the Market: Comodo, Sectigo, RapidSSL, Thawte, GeoTrust, DigiCert, AnyChart - JavaScript Charts, AnyChart Trial Version. In this post, we'll introduce you to the list of best SSL certificate providers so that you can pick up the most suitable one for your website. An SSL certificate provider (certificate authority) issues digital certificates to organizations or individuals after verifying their identity. Discover top SSL certificate brands including Comodo, GeoTrust, DigiCert, Sectigo & more. Find the best Global SSL certificate for your website's security. A certificate authority (CA) is a trusted entity that issues digital certificates to individuals, organizations, websites etc. The primary role of a CA is to. To add SSL certificate authorities, 1. On the server-side SteelHead, choose Optimization > SSL: Certificate Authorities to display the Certificate Authorities. Buy your Comodo SSL certificates directly from the No.1 Certificate Authority powered by Sectigo (formerly Comodo CA). Fast service with 24/7 support. The Certification Authority Browser Forum (CA/Browser Forum) is a voluntary gathering of Certificate Issuers and suppliers of Internet browser software and. Premium protection from a trusted certificate authority. Find the SSL certificate that's right for your site, including Wildcard, SSL and server certs. Free SSL certificates issued instantly online, supporting ACME clients, SSL monitoring, quick validation and automated SSL renewal via ZeroSSL Bot or REST. Sectigo is a leading provider of SSL certificates & automated certificate management solutions. A Certificate Authority trusted by global brands for 20+. An SSL Certificate is a popular type of Digital Certificate that binds the ownership details of a web server (and website) to cryptographic keys. These keys are. What to look for in an SSL Provider ; Product features - Does the certificate authority provide a certificate with the features you need? ; Support - Does the. A certificate authority (CA) is a an organization that acts to validate identities and bind them to cryptographic key pairs with digital certificates. A certificate authority is a company or organization that acts to validate the identities of entities (such as websites, email addresses, companies, or. The SSL Store™, the world's leading SSL Certificate Provider, offers trusted SSL Certificates from DigiCert, Thawte, GeoTrust, Sectigo, Comodo. Easily manage, install and auto-renew free SSL/TLS certificates from ostashkovadm.ru and other ACME Certificate Authorities for your IIS/Windows. For an SSL certificate to be valid, domains need to obtain it from a certificate authority (CA). A CA is an outside organization, a trusted third party, that. SSL certificates can be obtained directly from a Certificate Authority (CA). Certificate Authorities – sometimes also referred to as Certification Authorities –.

How Much Do You Pay In Taxes If Self Employed

Self employment tax is slightly more than 15%, set aside that much every time you draw a dime from your business. You can estimate your income. Any leftover “net income” from your business will be taxed at %, and there's almost nothing you can do about it. You can estimate how much you'll end up. The “self-employment tax” means you'll pay up to % for Social Security and Medicare taxes, since you're considered as both employer and employee. This tax comprises a % Social Security tax and a % Medicare tax. If you earn $, or above in self-employment income (or $, for married couples. Self-employment income is calculated by subtracting the cost of doing business from the gross income or “profit” from the business, but before subtracting FICA. All these write-offs get subtracted from your income, meaning there's less income you need to pay tax on. If your deductible business expenses add up to $15, Self-employed workers are taxed at % of their net profit. This percentage is a combination of Social Security (%) and Medicare (%) taxes, also known. What percent do independent contractors pay in taxes? The self-employment tax rate is %, of which % goes to Social Security and % goes to Medicare. The self-employment tax rate is %. This breaks out into % for Social Security tax and % for Medicare. The self-employment tax applies to your. Self employment tax is slightly more than 15%, set aside that much every time you draw a dime from your business. You can estimate your income. Any leftover “net income” from your business will be taxed at %, and there's almost nothing you can do about it. You can estimate how much you'll end up. The “self-employment tax” means you'll pay up to % for Social Security and Medicare taxes, since you're considered as both employer and employee. This tax comprises a % Social Security tax and a % Medicare tax. If you earn $, or above in self-employment income (or $, for married couples. Self-employment income is calculated by subtracting the cost of doing business from the gross income or “profit” from the business, but before subtracting FICA. All these write-offs get subtracted from your income, meaning there's less income you need to pay tax on. If your deductible business expenses add up to $15, Self-employed workers are taxed at % of their net profit. This percentage is a combination of Social Security (%) and Medicare (%) taxes, also known. What percent do independent contractors pay in taxes? The self-employment tax rate is %, of which % goes to Social Security and % goes to Medicare. The self-employment tax rate is %. This breaks out into % for Social Security tax and % for Medicare. The self-employment tax applies to your.

Most self-employed individuals end up in the % income tax range, with most people having an average (or “effective”) tax rate of around 14%. (You can read. You each also pay Medicare taxes of percent on all your wages - no limit. If you are self-employed, your Social Security tax rate is percent and your. percent of self-employment income above the Social Security wage base not in excess of the threshold amount for the percent Additional Medicare Tax; and. Generally, the IRS requires that self-employed individuals pay estimated taxes every quarter. This includes self-employment tax as well as income tax. This accounts for the fact that you only pay self-employment tax on % of your net earnings. (You use this percentage since employees pay half of Social. However, when you're self-employed, it's up to you to make sure that these taxes are paid in full. In total, your Social Security and Medicare tax is % of. It's the self-employed version of the Social Security and Medicare taxes paid on (almost) all wages in the US. The only other tax is federal. In , income up to $, is subject to the % tax paid for the Social Security portion of self-employment taxes (FICA). Your employment wages and tips. 34 Employers and employees share these taxes, each paying %. People who are fully self-employed and therefore subject to self-employment tax have to pay for. Self-employed individuals must file a tax return if their net earnings are at least $ Unlike traditional employees, who have taxes automatically withheld. Most people who pay into Social Security work for an employer. Their employer deducts Social Security taxes from their paycheck, matches that contribution. Single standard deduction in is $13, · Self-employed folks also get an additional deduction called Qualified Business Income (QBI). This. The short answer is yes, self-employed individuals usually pay more in taxes. However, they are also able to deduct half of the self-employment tax, as well as. Now that you're self-employed, you'll have to pay your taxes directly to the IRS and make quarterly tax payments four times per year. And if you miscalculate. Self-employed individuals must pay quarterly taxes to avoid penalties during tax season. Tax deductions and tax credits. When you're looking for ways to save on. In effect, they get a deduction on the employer portion (% Social Security + % Medicare = %) of their self-employment tax. How Do I Pay My FICA Tax. Anyone who is self employed is considered both the employer and the employee, meaning thet New York self employment tax must be paid. That amount is %. However, if you earned a total of $, from working this year, you would only owe $3, in self-employment tax. The rest of your income would be taxed at. As a self-employed person, you have to file an income tax return if your net earnings equal at least $ And even if they don't, you may still have to file an. Self-employment tax is comprised of Social Security and Medicare taxes. This tax amount is in addition to your other income taxes assessed on the net income.

Best Stock Tracking App For Beginners

2> Yahoo Finance: Yahoo Finance provides comprehensive stock tracking features, including customizable watchlists, interactive charts, and news. Access the ultimate app for share market. Supercharge your financial journey with US stocks & ETFs. Unlock online trading success & high returns with. Yahoo Finance is one of the best options out there for researching a ticker and tracking the basics of the market, especially for beginners. Access the ultimate app for share market. Supercharge your financial journey with US stocks & ETFs. Unlock online trading success & high returns with. Topping our list of best AI stock trading bots is Trade Ideas, which is an impressive stock trading software supported by an incredibly talented team. The booming popularity of commission-free trading apps like Robinhood (HOOD) has made stock trading more accessible than ever to new investors. With just a. Robinhood is best for beginner investors and active traders. Their platform is easy to use; there aren't a ton of extra bells and whistles to distract the user. Best Portfolio Tracking Apps · Seeking Alpha. Best overall, especially for comprehensive investment analysis. · Empower. Best for monitoring bank accounts and. The 4 Top Portfolio Management Apps · 1. Empower (Formerly Personal Capital) · 2. SigFig Wealth Management · 3. Sharesight · 4. Yahoo! Finance. 2> Yahoo Finance: Yahoo Finance provides comprehensive stock tracking features, including customizable watchlists, interactive charts, and news. Access the ultimate app for share market. Supercharge your financial journey with US stocks & ETFs. Unlock online trading success & high returns with. Yahoo Finance is one of the best options out there for researching a ticker and tracking the basics of the market, especially for beginners. Access the ultimate app for share market. Supercharge your financial journey with US stocks & ETFs. Unlock online trading success & high returns with. Topping our list of best AI stock trading bots is Trade Ideas, which is an impressive stock trading software supported by an incredibly talented team. The booming popularity of commission-free trading apps like Robinhood (HOOD) has made stock trading more accessible than ever to new investors. With just a. Robinhood is best for beginner investors and active traders. Their platform is easy to use; there aren't a ton of extra bells and whistles to distract the user. Best Portfolio Tracking Apps · Seeking Alpha. Best overall, especially for comprehensive investment analysis. · Empower. Best for monitoring bank accounts and. The 4 Top Portfolio Management Apps · 1. Empower (Formerly Personal Capital) · 2. SigFig Wealth Management · 3. Sharesight · 4. Yahoo! Finance.

Schwab's stock trading app for mobile devices help you stay connected to the markets. Place trades, monitor stocks, and take a custom watch list wherever. The Best Free Stock Tracking Spreadsheet you'll find using Google Sheets. Simple and Easy to Use. Get it here and see how it works. Advanced portfolio tracking, investment analytics & reporting tools. Track performance, dividend income, currency gains & more. Get started now! 1) Monitor your stocks in a portfolio · 2) Track stock purchase by transactions · 3) Transactions compatible includes purchase, sale, dividend and stock splits · 4. The Yahoo Finance app offers comprehensive insights, news, real-time stock quotes, and more–all tailored for your personal stock portfolio. Make investing moves on the go · Trade US stocks, commission-free with no account fees or minimums for brokerage accounts · Create savings goals and track your. Track your spending, investments, and net worth in the best-in-class app for Mac and iPhone. Personal capital can be considered the most popular investment tracking app. It has million registered users, tracking over $ billion in assets. Kernel: Best App or Platform for Specialised Index Funds; Simplicity Investment Funds: Best App or Platform for Low-Cost Index Funds. Disclaimer: Interactive. Leading online stock portfolio tracker & reporting tool for investors Powerful portfolio tracking software that lets you check your investments in. The 4 Top Portfolio Management Apps · 1. Empower (Formerly Personal Capital) · 2. SigFig Wealth Management · 3. Sharesight · 4. Yahoo! Finance. Yahoo Finance - Stock Market 4+. Stocks, Business & Investing. Yahoo · #79 in Finance. A simple, efficient, andfree stock tracking appfor your inventory. Get all the essential inventory tracking features bundled in one FREE app. Create a custom stock game for your school or club! · Used by over 10, teachers and , students every year! · Includes student lessons and tutorials. Track all of your investments with the Investment Tracking App: Real Estate ✓ Stock market ✓ Forex ✓ Bonds ✓ Cryptocurrencies. This is the best and easiest digital investment tracking app I've ever used. · All you need to look after all of you crypto! · Best portfolio app, not just for. Beginner or intermediate stock and mutual fund investors need even Best investment apps help users to track the performance of their portfolio easily. Track your spending, investments, and net worth in the best-in-class app for Mac and iPhone. Best for Beginners: Groww. Groww is the perfect choice for novice investors looking to dip their toes into the stock market. Its user-friendly design and. Best Online Stock Brokers · Best Investment Apps · View All · Mortgages. Mortgages Learn More A Beginner's Guide to Investing in Stocks. How to start.

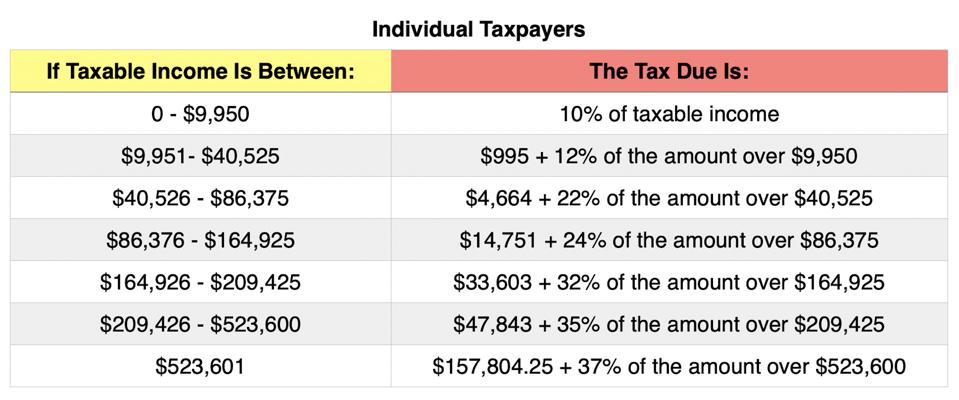

Personal Tax Rates 2021

The local income tax is calculated as a percentage of your taxable income. Local officials set the rates, which range between % and % for the current. tax due on an annualized basis for each quarterly period. Ninety percent of the tax computed at the applicable rates on the basis of the actual taxable income. Personal income tax rates ; Single taxpayers (1) · 0 to 11, · 11, to 44, ; Married taxpayers filing jointly (1, 2) · 0 to 22, · 22, to 89, ; Head-of-. Marginal tax rates and income brackets for Marginal tax rate, Single taxable income, Married filing jointly or qualified widow(er) taxable income. Learn about new tax relief, the short-term capital gains tax rate change, the 4% surtax, and more. Scroll to see more. Video, Reviews. Individual Income Tax rates range from 0% to a top rate of 7% on taxable tax year you would select period Dec); On the next screen. Tax Information for Individual Income Tax. For tax year , Maryland's personal tax rates begin at 2% on the first $ of taxable income and increase up to. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 8. Table 5. Personal Exemptions, Standard Deductions. For Tax Years , , and the North Carolina individual income tax rate is % (). For Tax Years and , the North Carolina individual. The local income tax is calculated as a percentage of your taxable income. Local officials set the rates, which range between % and % for the current. tax due on an annualized basis for each quarterly period. Ninety percent of the tax computed at the applicable rates on the basis of the actual taxable income. Personal income tax rates ; Single taxpayers (1) · 0 to 11, · 11, to 44, ; Married taxpayers filing jointly (1, 2) · 0 to 22, · 22, to 89, ; Head-of-. Marginal tax rates and income brackets for Marginal tax rate, Single taxable income, Married filing jointly or qualified widow(er) taxable income. Learn about new tax relief, the short-term capital gains tax rate change, the 4% surtax, and more. Scroll to see more. Video, Reviews. Individual Income Tax rates range from 0% to a top rate of 7% on taxable tax year you would select period Dec); On the next screen. Tax Information for Individual Income Tax. For tax year , Maryland's personal tax rates begin at 2% on the first $ of taxable income and increase up to. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 8. Table 5. Personal Exemptions, Standard Deductions. For Tax Years , , and the North Carolina individual income tax rate is % (). For Tax Years and , the North Carolina individual.

Historical Tax Tables may be found within the Individual Income Tax Booklets. The Taxation and Revenue Department offers taxpayers the ability to file their tax return online and check the status of their refunds through the Taxpayer. The following corporate income tax rates were effective for tax years beginning on or after January 1, and before January 1, Fiscal years that began. Tax Types Current Tax Rates Prior Year Rates Business Income Tax Effective July 1, Corporations – 7 percent of net income Trusts and estates – tax brackets and federal income tax rates ; 10%, $0 to $9,, $0 to $19, ; 12%, $9, to $40,, $19, to $81, ; 22%, $40, to $86,, $81, Personal income tax rate charts and tables. tax year rate charts and For example, timely-filed returns were due on April 18, and will. for through , any federal qualified business income deduction for taxpayers Federal taxable income is multiplied by marginal income tax rates and tax. Tax Rates ; January 1, – December 31, , % or ; January 1, – December 31, , % or ; January 1, – December 31, , %. Personal Income Tax Rates · Withholding Tax Rates · Current & Historic Enactment FYI New Mexico Withholding Tax - Effective January 1, , Open. Personal income tax rate charts and tables. tax year rate charts and For example, timely-filed returns were due on April 18, and will. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. Personal Income Tax · Tax Rate Schedules and Tables · Filing Status · Taxable Vermont Tax Tables. Tax Year Vermont Rate Schedules · Rates for Tax Years ; Not over $10, 4% of the taxable income. ; Over $10, but not over $40, $, plus 6% of the excess over $10, ; Over. Personal Income Tax Booklet If Your Taxable. Income Is The Tax For. Filing Status. At. Least. But Not. Over. 1 Or 3. Is. 2 Or 5. Is. 4. Is. $1. $ Tax Types Current Tax Rates Prior Year Rates Business Income Tax Effective July 1, Corporations – 7 percent of net income Trusts and estates – income, your tax rate is generally less than that. First, here are the tax rates and the income ranges where they apply: Tax Year: , , , , CAUTION! The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. 2 percent on first $ of taxable income; 4 percent on next $2,; 5 percent on all over $3, Married persons filing a joint return with adjusted gross. The standard Personal Allowance is £12,, which is the amount of income you do not have to pay tax on. Your Personal Allowance may be bigger if you claim. Current Tax Rates ; Personal Income Tax, percent ; Inheritance and Estate Tax, 0 percent on transfers to a surviving spouse or to a parent from a child aged.

How To Get Pmi Off

Another way to remove PMI prior to having 22% or more equity would be to refinance into an 80–10– This loan is a Conventional first lien at. If you are a homeowner paying for Private Mortgage Insurance, or "PMI," you may qualify for PMI cancellation or wish to take steps to qualify for cancellation. 4 options to get rid of PMI · Wait for PMI to terminate automatically. · Request PMI cancellation. · Refinance to get rid of PMI. · Refinance into a piggyback loan. Saving up a higher down payment can be difficult, but it pays off. In addition to getting out of MIP at 11 years, it lets you qualify for an FHA loan with a. Ask to cancel your PMI: If your loan has met certain conditions and your loan to original value (LTOV) ratio falls below 80%, you may submit a written request. First, you have the right to request the removal of PMI when your principal loan balance is scheduled to fall below 80% of your home value. Depending on how much you put down, PMI can cost anywhere from –% of your loan balance per year. It protects your lender—not you—in case you stop making. How to remove PMI. Generally, once you reach 20% equity or when you pay your loan balance down to 80% of the purchase price of your home, you. You may not be able to remove PMI by refinancing unless you have at least 20% equity in your home. The rules for removal of MIP are different for FHA loans and. Another way to remove PMI prior to having 22% or more equity would be to refinance into an 80–10– This loan is a Conventional first lien at. If you are a homeowner paying for Private Mortgage Insurance, or "PMI," you may qualify for PMI cancellation or wish to take steps to qualify for cancellation. 4 options to get rid of PMI · Wait for PMI to terminate automatically. · Request PMI cancellation. · Refinance to get rid of PMI. · Refinance into a piggyback loan. Saving up a higher down payment can be difficult, but it pays off. In addition to getting out of MIP at 11 years, it lets you qualify for an FHA loan with a. Ask to cancel your PMI: If your loan has met certain conditions and your loan to original value (LTOV) ratio falls below 80%, you may submit a written request. First, you have the right to request the removal of PMI when your principal loan balance is scheduled to fall below 80% of your home value. Depending on how much you put down, PMI can cost anywhere from –% of your loan balance per year. It protects your lender—not you—in case you stop making. How to remove PMI. Generally, once you reach 20% equity or when you pay your loan balance down to 80% of the purchase price of your home, you. You may not be able to remove PMI by refinancing unless you have at least 20% equity in your home. The rules for removal of MIP are different for FHA loans and.

PMI can be removed during a refinance if you have reached 20% equity. You can speed up the process of reaching % by making extra payments toward your. If you're current on your mortgage payments, PMI will automatically terminate on the date when your principal balance is scheduled to reach 78% of the original. One strategy to avoid PMI involves getting an 80/10/10 loan where you put 10% down and take out a 10% home equity line of credit and use that to satisfy the 20%. To request cancellation of PMI, you should contact your loan servicer when the loan balance falls below 80 percent of your home's original value (the contract. If you're on conventional loan, you can request PMI off once you reach 20% equity based on the original value used for the loan at that time of. 4 options to get rid of PMI · Wait for PMI to terminate automatically. · Request PMI cancellation. · Refinance to get rid of PMI. · Refinance into a piggyback loan. Ask your lender or mortgage servicer for information about these requirements. If you signed your mortgage before July 29, you can request to have the PMI. PMI is associated with conventional loans and can often be removed once you reach 20% equity in your home. MIP, on the other hand, is for FHA loans and has. You can request to have PMI removed from your loan when your balance reaches 80% loan-to-value (LTV) based on the original value. If your mortgage balance is less than or equal to 80% of your home's current value, then your new (refinance) loan will not have PMI. If removing PMI is your. When does mortgage insurance go away? PMI is required until your loan has met certain conditions, like having 20% equity in your home based on it's original. The law says you can ask that your PMI be canceled when you've paid down your mortgage to 80% of the loan. A loan recast is another great approach to removing PMI. If a recast drops your Loan-To-Value ratio (LTV) to 80% or below, your loan will become eligible for. PMI is automatically terminated when a borrower reaches a 78 loan-to-value ratio (LTV) based on the original value of their home. Beginning in , lending institutions have been obligated to cancel a borrower's Private Mortgage Insurance (PMI) when his mortgage balance (for loans. Once you reach 20% equity in your home, you have another option for removing PMI without refinancing. You can apply to cancel the PMI. This involves submitting. PMI is usually taken off once the 80LTV (or below) is reached. Or, as an owner, you can have your home appraised to discover present value. The. (Loans with LPMI can only be canceled when they are paid off or refinanced.) Some states, notably NY, also have cancellation laws that predate and can supersede. The best way to avoid PMI is to make a down payment of at least 20% of the home's purchase price. If you don't have a big down payment, ask your lender about. Removing PMI · Your loan must be current. · In the last 12 months, you can't have been more than 30 days late on any payment. · In the last 24 months, you can't.

1 2 3 4 5 6